Estimated 2022 tax brackets

Here is a look at what the brackets and tax rates are for 2022 filing 2023. Marginal tax rates for 2022 havent changed but the level of taxable income that applies to each rate has gone up.

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

This calculator is for 2022 Tax Returns due in 2023.

. The 2022 Estimated Tax. 2022 Tax Brackets Due April 15 2023 Tax rate Single filers Married filing jointly Married filing. Knowing which tax bracket you are in can help you make better financial decisions.

We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Tax brackets work incrementally.

There are seven federal income tax rates in 2022. If taxable income is under 22000. Your 2021 Tax Bracket to See Whats Been Adjusted.

As announced in the 202223 Federal Budget the low and middle income tax offset LMITO has been increased by 420 for the 202122 income year. Effective tax rate 172. TurboTax Tax Calculators Tools Tax Bracket Calculator.

2021 federal income tax brackets for taxes due in April 2022 or in. The 2022 Projected US. The Premium Amounts per IRMAA Bracket.

The NIIT doesnt apply to trusts where all of the unexpired interests are devoted to charitable. Highest income tax bracket applies to amounts over 13450. The Internal Revenue Service IRS is responsible for publishing the latest Tax Tables each year rates are typically published in 4 th quarter of the year proceeding the new tax year.

Ad Expatriate Tax Expert For Returns Planning and Professional Results. The tax is 10 of. According to the Medicare Board Trustees Report from 2019 the surcharges will inflate at as follows through 2028.

Low and middle income tax offset. The 2022 Estimated Tax Worksheet The Instructions for the 2022 Estimated Tax Worksheet The 2022 Tax Rate Schedules and Your 2021 tax return and instructions to use as a guide to. Ad Expatriate Tax Expert For Returns Planning and Professional Results.

That will determine your tax bracket for all of 2022. Allan and Louise are married and have three children. If youre 1000 into the next tax bracket only 1000 is taxed at the higher rate.

Theyre calendar-year filers who want to. Eligible dividends are those paid by public corporations and private companies. Estimated 2022 tax 90 percent.

Tax Bracket Calculator 2021. Deduct whatever amount was withheld from your paycheck by your previous employer and then youll have the total amount. Tax Rates report offers an early projection of deductions limitations upward changes to tax brackets thresholds and other inflation-adjusted factors.

The top rate of 37 applies to income. Louise is a teacher. It doesnt affect the income in the previous.

Discover Helpful Information and Resources on Taxes From AARP. Tax brackets and rates for the 2022 tax year as well as for 2020 and previous years are elsewhere on this page. The rates apply to the actual amount of taxable dividends received from taxable Canadian corporations.

The NIIT doesnt apply to trusts where all of the unexpired interests are devoted to charitable. Thats not true. The 2022 Estimated Tax.

The personal exemption for tax year 2022 remains at 0 as it was for 2021 this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act. Ad Compare Your 2022 Tax Bracket vs. Highest income tax bracket applies to amounts over 13450.

The tax rate schedules for 2023 will be as follows. Income Tax Brackets. For married individuals filing joint returns and surviving spouses.

In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

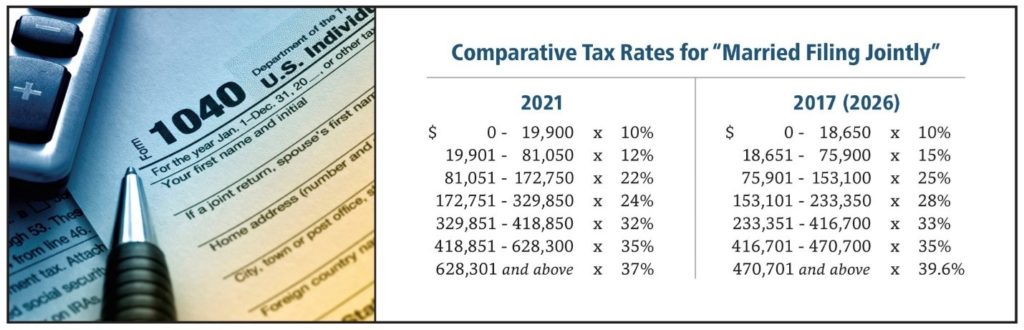

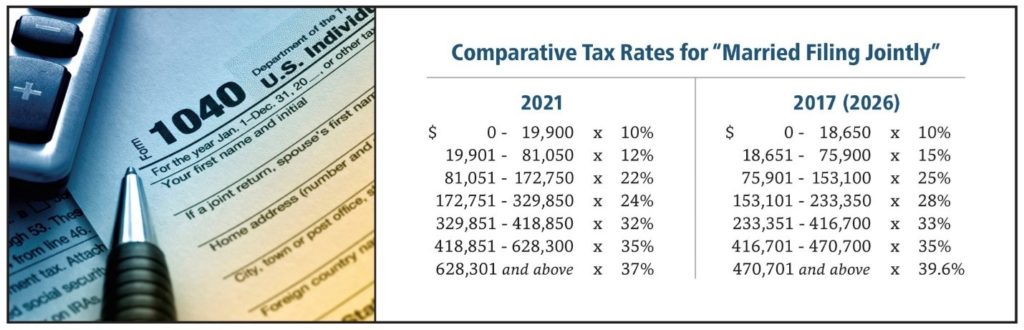

Start Planning Now For A Higher Tax Environment Pay Taxes Later

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Federal Income Tax Brackets Brilliant Tax

2022 Income Tax Brackets And The New Ideal Income

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

2022 Income Tax Brackets And The New Ideal Income

2022 Income Tax Brackets And The New Ideal Income

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Estimated Payments Or Withholding In Retirement Here S Some Guidance Kiplinger In 2022 Capital Gains Tax Estimated Tax Payments Retirement

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Paying Self Employment Tax For The First Time In 2022 Credit Karma Credit Counseling Tax Debt Relief

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor